Sometimes it seems that trading cryptocurrency is a 24 hour a day job. On my favorite exchange, Binance, they recently promoted a brief maintenance shutdown as a chance for traders to get some much needed rest. It was essentially discussed as a holiday. It doesn’t have to be that way though – Bots can help.

What is a bot? It is an algorithm that can book trades for you. You settle on a strategy, set the parameters in your bot, and let it run. In order for it to run you have to give it what is called API access, but that is fairly straightforward.

Consider one popular indicator – RSI. Many use RSI to tell them when to buy and when to sell. (Note – this isn’t financial advice, this is simply a discussion of how many use the RSI indicator). When the RSI is lower than a predetermined level, many take that as a buy indicator. When it goes above a different level, many sell.

Now if this sounds like the sort of thing which could be automated – it is. But man, searching for cryptocurrency bots is a lot of work. Then you find that many have high up-front costs, or high monthly costs. One online bot-service I have enjoyed using is Quadency. It is simple to use and affordable. In fact, if you link it with a supported exchange you get an extended free trial. This is the way to test and see if you will like a service.

Quadency Bot Basics

Is it hard to use? Definitely not. After you get initially set up and linked to your crypto exchange (this involves getting an API key from the exchange, and pasting it in the configuration), you can go to the ‘Bots’ screen. From there you will choose your bot, and set the parameters.

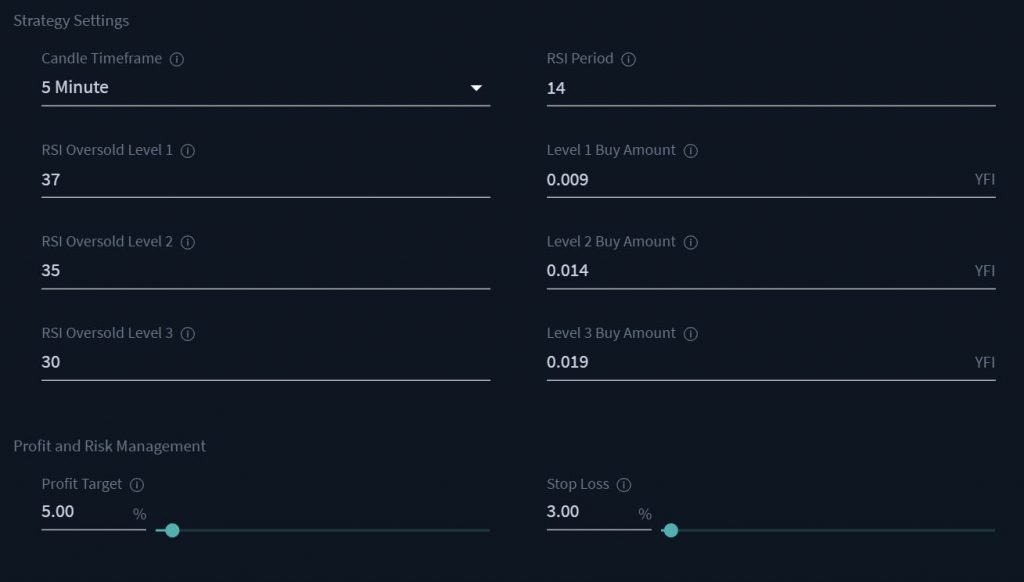

These are the parameters for the Multi-Level RSI v2 Bot. Most of these will be pretty familiar to anyone who has dabbled in cryptocurrency trading. (A basic discussion on Bitcoin and crypto is here) The trading pair I am using here is Yield Finanace (YFI) and Bitcoin (BTC). Notice that this is a multi-level bot – you can progressively buy more of the desired coin. This results in dollar cost averaging in to a position, which many consider to be a good idea.

So – does it work? It certainly can. One great feature Quadency offers is backtesting; after you choose your set parameters you can see how those would have worked over the past day or week or month. Of course, the old adage holds true – “past performance is no guarantee of future results.” Consider this backtest result from the above parameters:

In one week a gain of 3.67% was shown. If that could be achieved every week, in one year you would have over 600% gains, all without work.

With Crypto, Always Be Cautious

Now here is the rain for the parade – I am not telling you that if you plug in these exact parameters you will get 600% annual gains. This was one result. YFI later dropped against BTC, sharply. The saving grace was a stop loss was set. A stop loss triggers a sell order if the price falls below a certain level. So when it starts to drop, you will hopefully get out of the market, and only lose a little. If you have been at it a while, that slight loss will only be from your peak – you will still be up. But the risk is yours.

One think I did when I was first playing with bot-trading was this – I started small. While a 3% gain on a small amount is nothing to go crazy over, the first few bots and setting combinations I played with dropped big. The loss was nothing to lose sleep over either. Only once I gained comfort did I start to assign larger amounts to the bot.

Is bot-trading for you? Maybe. If you choose to try it out, please use my referral link (Quadency-click here) Yes, that is a referral link which pays to me if you use it. I write articles on the benefits of affiliate marketing – would you really expect otherwise? Don’t try to learn from someone who has never done what you are trying to do.

Best.